POPULAR FEATURES

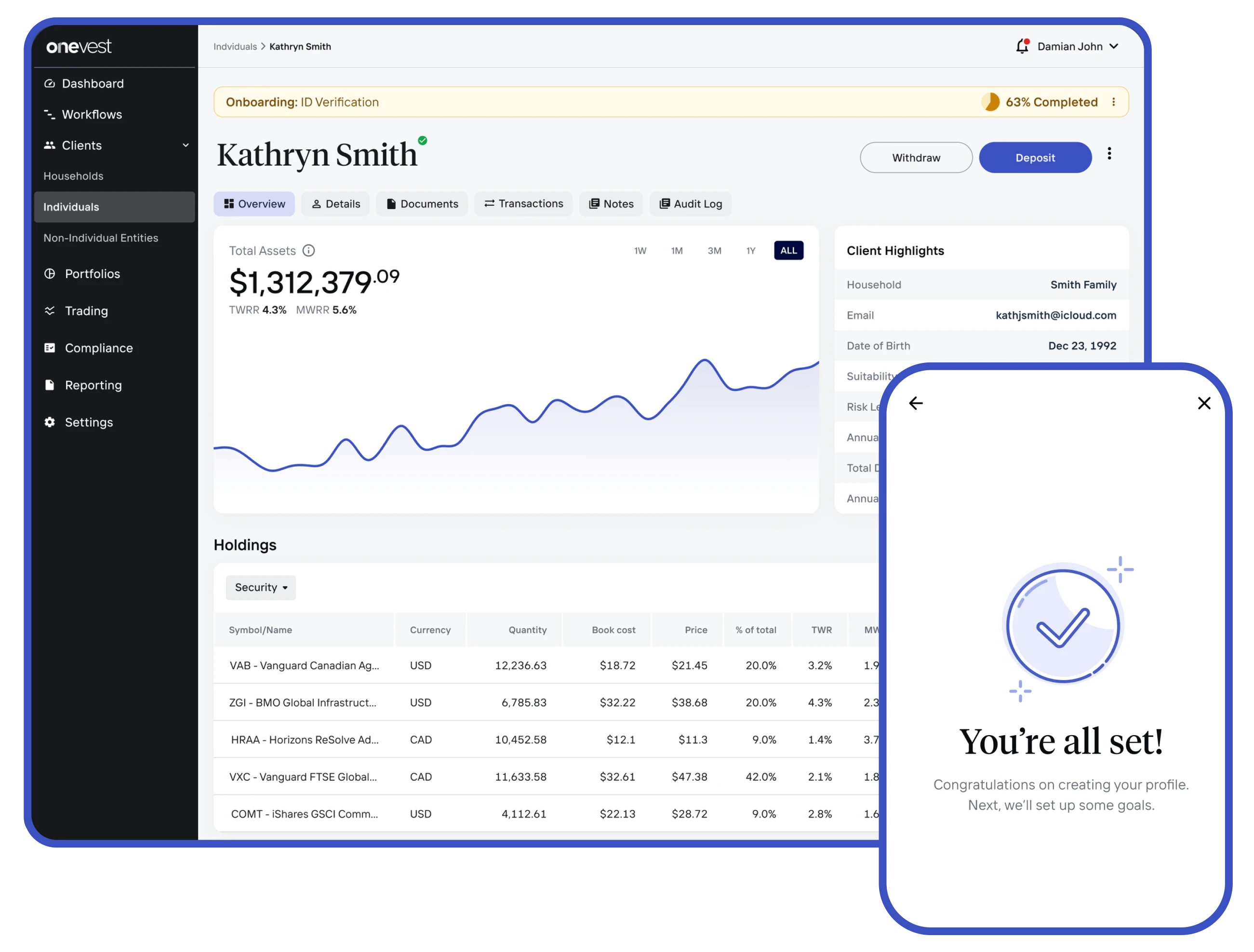

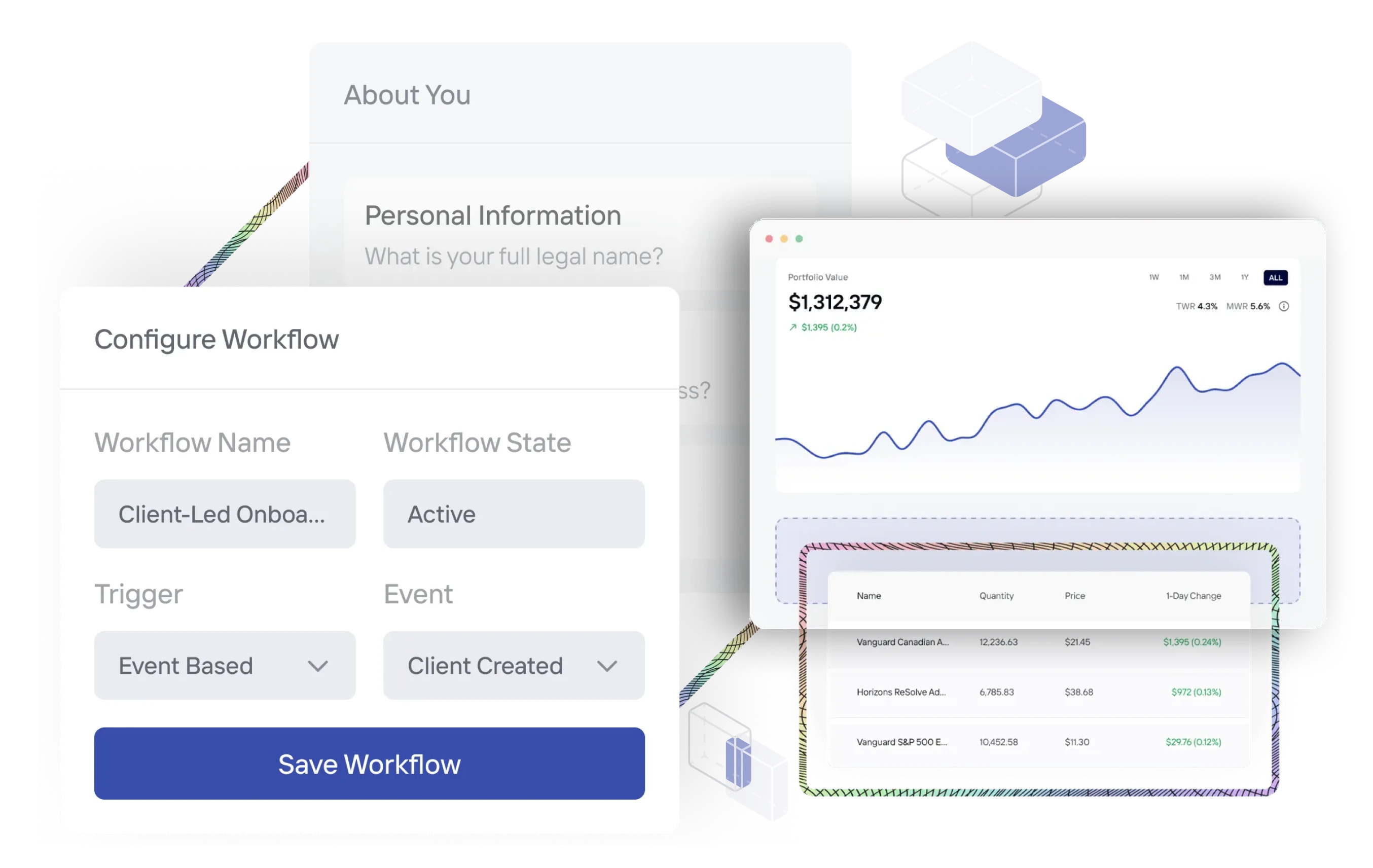

Onboarding

Streamline client onboarding with digital tools to collect KYC, verify IDs, generate documents, and set up accounts in minutes.

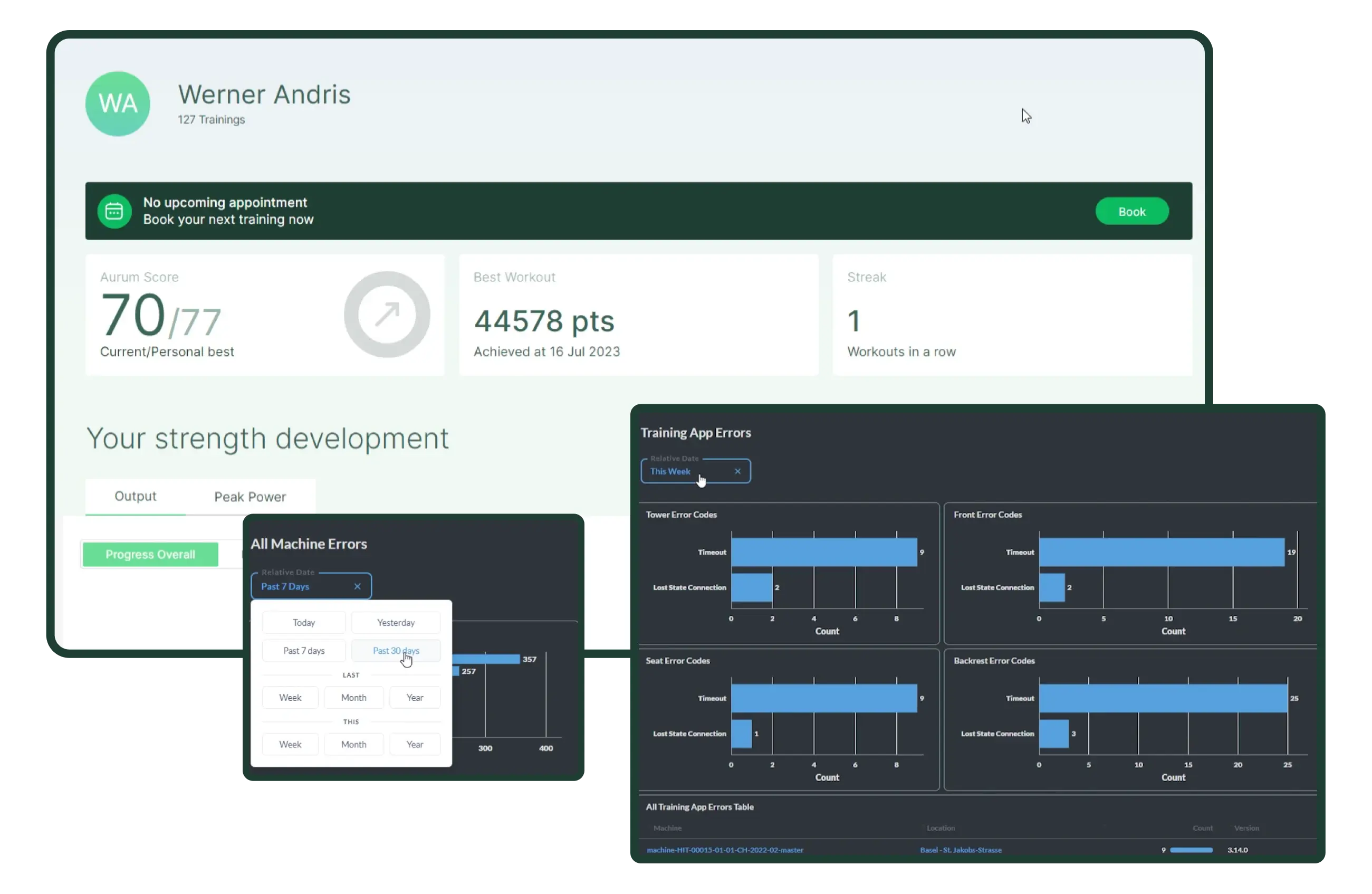

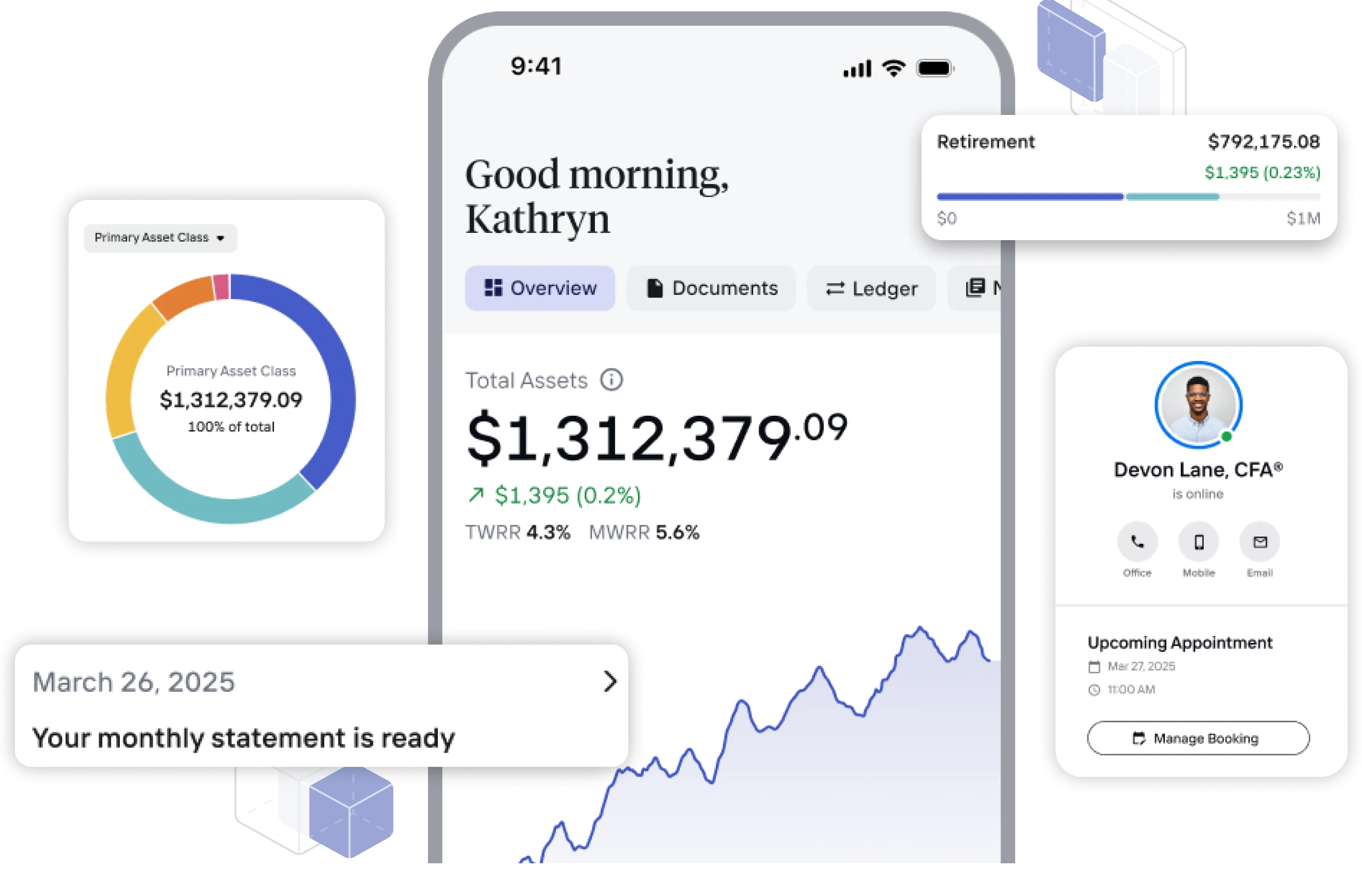

Client Portal

Enhance client experiences with a customizable portal that allows quick adjustments to text and settings to match your firm's needs.

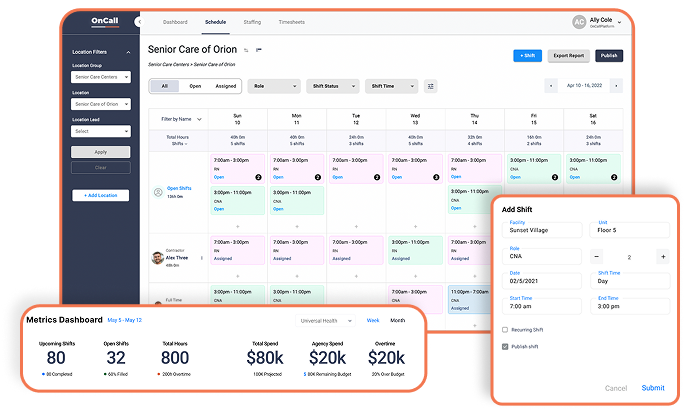

Advisor Portal

Manage client profiles, documents, and financial data in one simple platform for seamless wealth management.

Portfolio Management

Build and manage complex portfolios with automated rebalancing, one-click trading, and precise allocations at scale.

Fee Management

Easily customize and automate billing for different client types with transparent fee reporting and adjustable structures.

Compliance Tools

Ensure compliance with centralized reviews, real-time fraud detection, and streamlined reporting for effective risk management.

Analytics and Reporting

Gain a comprehensive view of client portfolios, track assets and fees, and generate custom reports for informed decision-making.

PROJECT REQUIREMENT

OneVest required support in building and maintaining wealth management modules for Canadian and US financial institutions.

- The admin panel needed a static page widget configuration to manage and update static pages independently without developer involvement.

- Gateway integration with Apex was necessary to expand the US reach and provide joint users with broader investment access.

- The secure Plaid integration was required to connect users' bank accounts directly with OneVest.

- Roles and permissions were essential for restricting access and ensuring only authorized individuals could make changes.

OUR APPROACH

OCloud Solutions follows a collaborative, timeline-driven approach to deliver high-quality features to enhance the OneVest

Task Execution

Delivered assigned tasks and resolved bugs within set timelines to ensure smooth and consistent development progress.

Team Collaboration

Actively collaborated with cross-functional teams by raising blockers early and assisting with PR reviews and suggestions.

Platform Support

Supported solutions and portal teams by improving integrations and enhancing the overall user experience.

Quality Assurance

Ensure functionality and quality through rigorous testing, PR reviews, task suggestions, and testing support to meet project delivery standards.

PROJECT SUCCESS

Delivered core fintech features for OneVest by following a structured, research-led process from planning to deployment.

- Worked on assigned features after PRD (Project Requirement Document), and TDD (Technical Design Document) approvals to ensure alignment with product and engineering goals.

- Contributed technical input where needed but followed decisions made through OneVest’s internal product research and planning cycle.

- Maintained smooth task flow using a Kanban model, focusing on client priorities and timely delivery of features.

- Raised blockers early within the team to avoid delays and support steady progress during development.

- Supported the project with three core developers and four additional team members working in sync across roles.

RESULTS

OCloud Solutions delivered scalable integrations to boost speed, improve performance, and streamline onboarding.

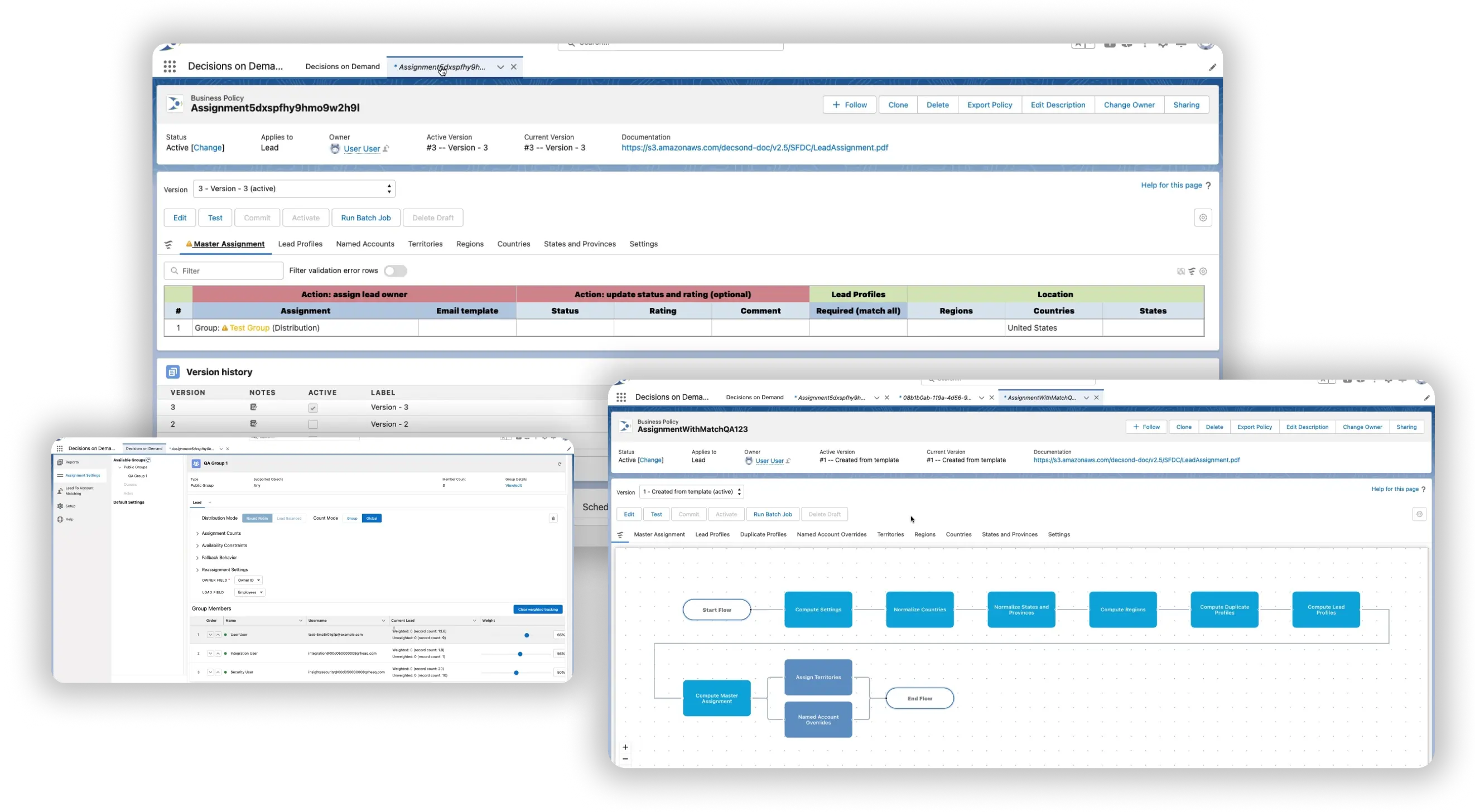

Integrated Plaid, Apex, and Salesforce Financial Cloud to ensure smooth data flow and real-time financial operations.

Customized solutions for multiple organizations, enhancing their operational flow and meeting unique business needs.

Upgraded Node.js versions from 14 to 22 to boost system compatibility, performance, and long-term support.

Used Windmill.dev for faster automation and webhook management due to tight deadlines and process optimization needs.

TECHNOLOGIES WE USE

Reactjs

Nodejs

Mongo DB

Amazon Web Services

AWS S3

Datadog

Google Places

Canada Post

Mixpanel